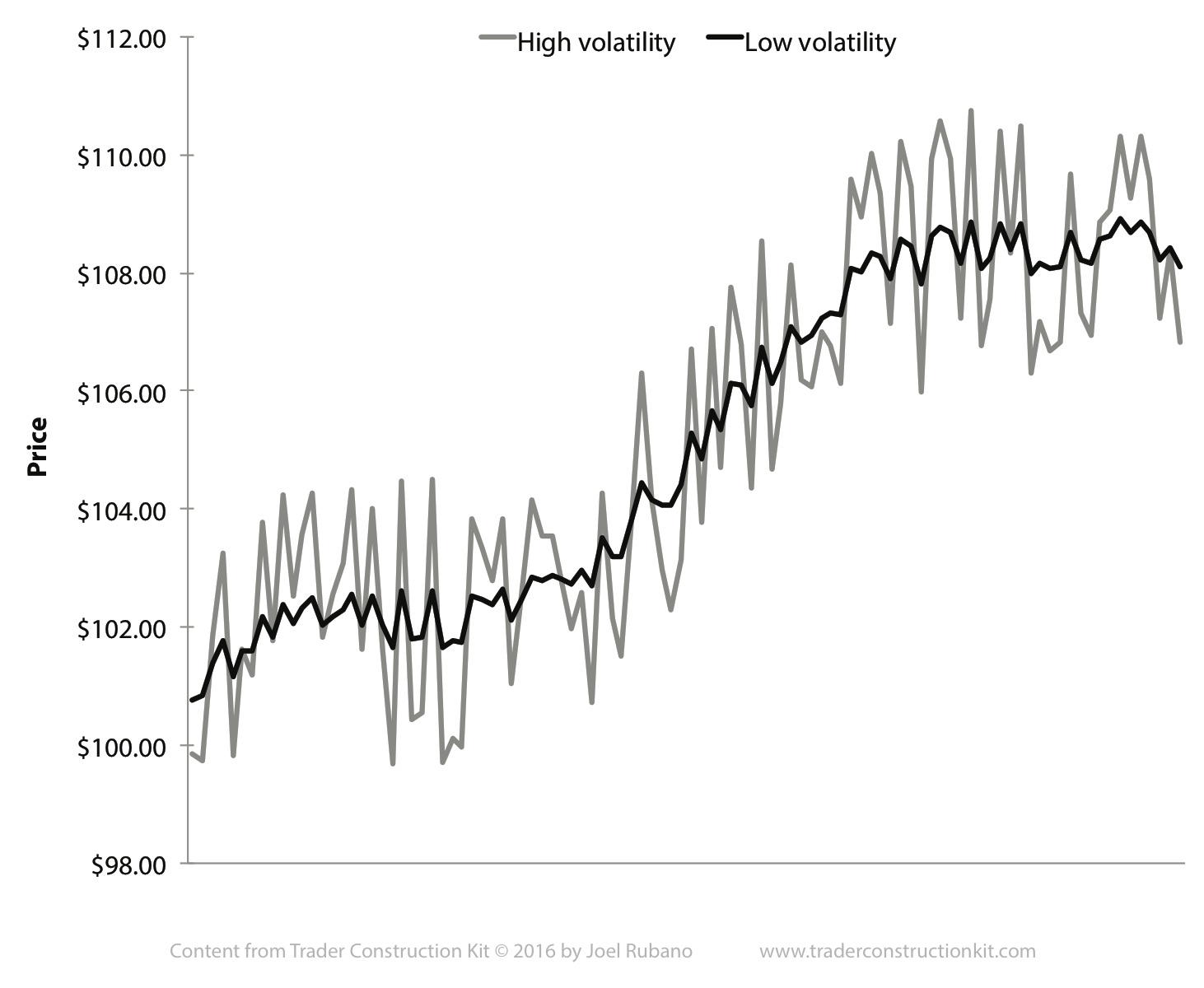

What the market is doing is important, but how it is doing it also greatly impacts the trader’s choice of strategy. The prevailing market conditions will, to a great extent, act to determine the types of trading strategies that can be productively employed at any particular point in time. Consider a graph of two price trajectories, one with high and one with low volatility, centered around the same sinusoidal trend:

Figure 8.1 High and low volatility price paths around the same central trend.

In the low volatility case it is possible to establish a long position early and hold it with minimal suffering. The move from $101.00 to $108.00 is relatively linear, with no material pullbacks to cause doubt or inflict mark-to-market pain. When the market plateaus between $108.00-109.00 there is a prolonged period of time to evaluate the position and exit the exposure.

In the high volatility case the trader is faced with daily fluctuations ranging between $2.00-$4.00 that severely distort the appearance of the in-progress trend. With perfect execution, it is possible that a skilled trader who recognizes the choppy conditions and is proficient at operating in dangerous markets could buy at $100.00 and, after riding out a material amount of volatility, sell at $110.00. A less-skilled (or less lucky) trader could easily buy early in the trend at $104.00 and sell late in the move at $106.00, making a paltry $2.00 (or about half a typical day’s trading range) for enduring a significant amount of suffering.

In a non-volatile market with tight bid-offer spreads there is often little difference between executing at the market bid or offer and exercising good tradecraft and negotiating a better price or providing liquidity by posting a two-way. The slight difference in price will not materially impact the profitability of the overall trade. In a volatile or panic-driven market the bid-offer spread can widen appreciably, forcing the trader to execute efficiently at both entry and exit or risk significantly eroding the potential inherent in the trade.

The prevailing volatility should be factored into the pre-trade risk-reward assessment, as seen in Chapter 7. The more volatile the market, the greater the skill necessary to execute and establish a position at levels that will allow it to be survivable. At extreme levels of volatility survivability becomes a key consideration, and the ratio between the amplitude of the daily and intraday fluctuations and the pain the trader can afford to endure before being stopped out of the position must be carefully considered. A market exhibiting daily swings that are wider than a trader’s stop means that even with optimal execution there is a high probability that the trader could be forced out of her position within the next 24 hours. There is no magic formula to determine how much volatility is too much. Assessing the relative operability of the prevailing conditions comes down to the trader’s skill, experience, and not infrequently, self-confidence.

From Chapter 8 - Directional Trading Strategies, Pages 287-288.

To read more, click here. To purchase Trader Construction Kit, click here. To see future updates about new Excerpts, follow @TCK_JRubano on Twitter.

Excerpt from Trader Construction Kit Copyright © 2016 Joel Rubano. All rights reserved. No part may be reproduced in any form or by any electronic or mechanical means, including information storage and retrieval systems, without permission in writing from the publisher, except by reviewers, who may quote brief passages in a review.